vcAdviser leverages financial derivatives valuation method to analyze term sheet deals. The tool does the heavy math so you don’t have to. However, it is expected that in-depth understanding of the calculations performed by the tool are of interest to some vcAdviser users, including:

- Finance professors and students who study in depth entrepreneurial finances

- Finance professionals who treat with healthy distrust all black box systems performing hidden calculations

Introduction

vcAdviser explains how the angel/VC investors utilize the convertible preferred stock structure, specified in a term sheet, to claim their share of the present (current) value of the startup enterprise, as well as, claim their part of proceeds from future liquidity events, e.g. sale of the company to a strategic buyer, IPO, buyout or bankruptcy. It is important to understand that the tool does not focus on estimating the present value of the entire startup company (enterprise) – startup enterprise valuation methods, a mix of art and science, have already been amply described by many existing publications and tools. Instead, vcAdviser uses the estimated startup value as a starting point and focuses on clearly illustrating how as a result of the angel/VC investment deal the total startup enterprise value is divided between the angel/VC investors and the company founders, as determined by the total often hard to understand arcane deal terms specified in the term sheet.

Convertible Preferred Stock

The current version of vcAdviser focuses on the equity financing, as opposed to debt financing. Equity financing involves raising money by selling interests (shares) in the company. Debt financing involves borrowing money to be repaid, plus interest.

It has become customary for professional venture investors to structure rounds of equity financing with convertible preferred stock. As the name indicates the investor in the company preferred stock is given a preferential treatment over other company shareholders, specifically the founders holding common stock of the same company.

Example

In order to illustrate the concept of the preferential treatment offered to investors in the preferred stock let’s consider an example of a company that is seeking an investment of $3M. Let’s assume that the current (“pre-money”) company valuation is $4.5M.

If the company obtains the $3M financing then its new valuation (“post-money”) will be $7.5M ($7.5M = $3M+$4.5M). Let’s assume that until now the company issued only common stock. For comparison purposes let’s analyze alternative scenarios in which the new $3M investment is made either in common or preferred stock.

Scenario 1 - Investment in Common Stock

The investor who invests $3M in exchange for common stock will be provided with 40% (40% = $3M/$7.5) of the outstanding shares of common stock. Therefore, the investor expects to be paid 40% of the proceeds upon company liquidity events, such as a company acquisition, IPO or bankruptcy.

Scenario 2 – Investment in Convertible Preferred Stock

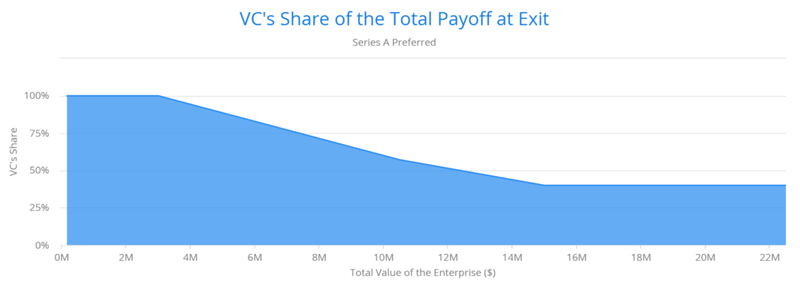

The investor who invests $3M in exchange for convertible preferred stock that is convertible into 40% of the outstanding shares of common stock, will be entitled to collect at least 40% of the proceeds upon liquidity events. The investor’s share in the liquidation proceeds will range from 100% to 40%, depending on the total proceeds and the deal terms governing the issuance of the convertible preferred stock. For example, if the deal terms assign to the preferred stock the liquidation preference of one times the original investment then the investor will obtain 100% of the proceeds from any liquidity event for which the total proceeds do not exceed $3M.

Valuation Challenge

Basic economics teaches that the present value of the enterprise is equal to the present value of all the future cash flows that will be provided to investors, e.g., the cash flow provided to investors upon liquidity events, such as company acquisition, IPO or bankruptcy. All investors in the enterprise, including the company founders and VCs, hold rights to receive part of the future cash flows generated by the company. While the startup total value is equal to the present value of all the cash flows to all investors, the value of the investment held by the specific investor/founder is equal to the present value of his/her share of the cash flows.

As illustrated in the above example, the angel/VC investor’s percentage share in the future cash flow will in some circumstances be substantially higher than the angel/VC investor’s monetary contribution to the startup’s present (“post-money”) value.

When the investor in preferred stock contributes through his/her investment 40% of the present value (post-money value) of the enterprise, the investor obtains in exchange for his investment the right to receive somewhere between 40% and 100% of future cash flows depending on the liquidity event’s total proceeds and the deal terms governing the issuance of the convertible preferred stock. Specifically in the above example, while in both Scenarios the investor provides finances equivalent to 40% of the post-money value of the enterprise, in Scenario 2 the investor receives in exchange a higher than 40% share of the enterprise present value.

In general, through the use of preferred stock, the angel/VC investor is granted a disproportionately higher share in the enterprise current value than the percentage implied by his/her investment contribution.

It is important to point out, that it is not intended to imply here that angel/VC investor unfairly receives a disproportionate share of the startup value. There are many reasons why such preferred arrangement could be justified. For example, the VC typically contributes valuable intangibles such as know-how and industry contacts. The purpose of the tool is just to provide an understanding of the quantitative aspects of the deal. In order to obtain the full picture of the deal the quantitative considerations must be combined with qualitative aspects of the deal.

The challenge is that, due to complex nature of angel/VC investment deals, it is not easy to quantitatively assess how much of the present value of the enterprise the VC investor obtains in exchange for his/her investment. vcAdviser leverages the financial derivative analysis methods to meet the challenge.

Valuation Approach

vcAdviser utilizes financial derivatives analysis methods to estimate the present value of the convertible preferred stock shares in the startup. The derivative valuation numerical method is based on binomial trees. The binomial tree is used for modelling the future valuations of the startup enterprise, modelling the future payoffs to the investors and founders, and estimating the present value of those payoffs. For those, who are interested in the detailed examination of the vcAdviser models, the tool provides the ability to display the binomial tree model and examine parameters associated with every node of the binomial tree.

For those who are not familiar with financial derivatives and their valuation, vcAdviser illustrates the general concepts by analyzing one of the simplest financial derivatives, European stock call option. This feature may be particularly useful when vcAdviser is used for teaching entrepreneurial finance to finance students. After the students become familiar with valuation of simple stock options, it may be easier to grasp how the same approach is leveraged to analyze the term sheet deals.

Valuation of Stock Call Option

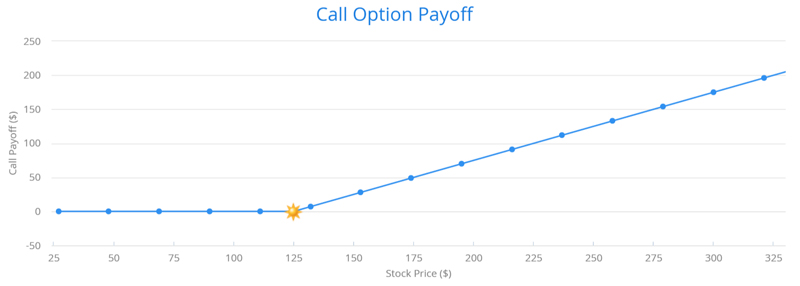

The owner of the European stock call option with exercise price P and maturity of n months has a right to purchase the underlying stock for price P in n months from now. The payoff chart below describes the cash flow that the option owner will receive in n months from now. If the price of the underlying stock is less than or equal to P then the option owner will receive zero cash because the owner, being a rational investor, will not exercise his right to buy the stock for P since the stock could be bought on the market for less than P. If the price S of the underlying stock is greater than P then the option owner will receive positive zero cash flow – the option holder could buy the stock for P and then sell the stock for S, realizing the profit equal to S-P . In the latter case, the greater the underlying stock price the greater the proceeds received by the option owner since the option owner can buy the stock for a fixed price P.

While it is easy to determine the value of the option at its maturity when the price of the underlying stock is known it is much harder to estimate the present value of the option when there is considerable time before the option expires and the price of underlying stock varies as influenced by the market. Fortunately, the intellectual giants that came before us managed to solve the problem. The Black–Scholes formula gives an estimate of the price of European-style options. More importantly for our case, there are numerical methods, such as binomial trees, that can be used for estimating the present value of the derivatives where derivatives payoff functions are more complex than payoff functions for European stock call options and where the derivatives rights could be exercised before the derivative maturity/expiration.

Valuation of Convertible Preferred Stocks

The stock call option is a financial derivative because it entitles the option holder to derive value based on the performance of the underlying asset (stock). Similarly, the convertible preferred stock can be considered a financial derivative that entitles the preferred stock owner to derive value based on the performance of the underlying asset, which is in this case the startup enterprise.

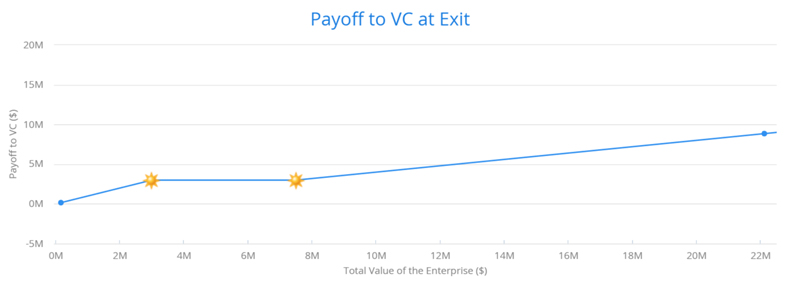

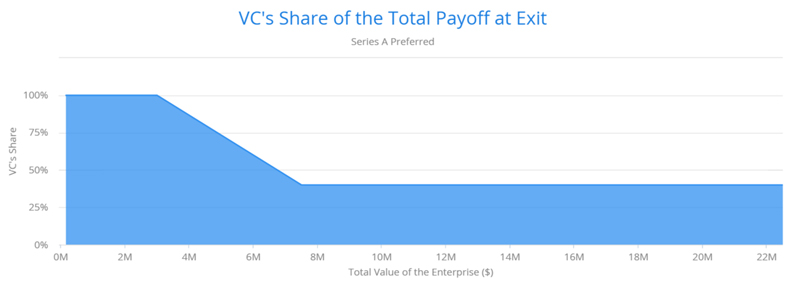

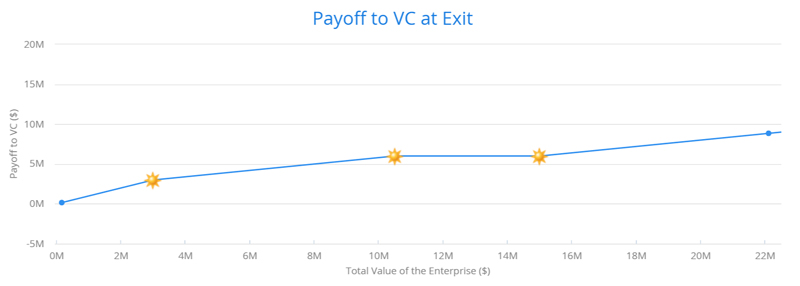

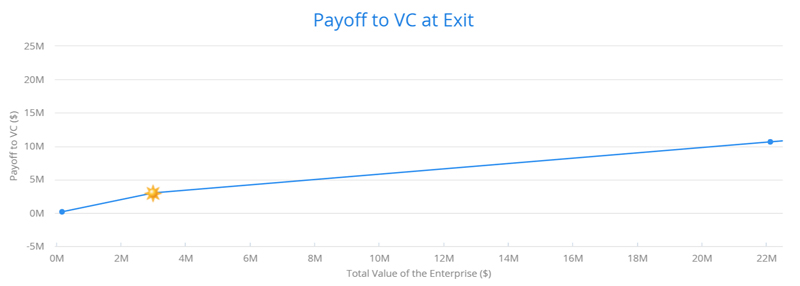

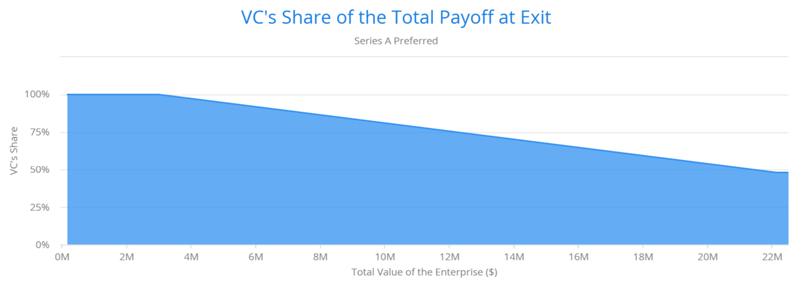

The convertible preferred stock payoff function is determined by the characteristics of the preferred stock, as specified by the VC term sheet. The charts below represent payoff functions for sample convertible preferred stocks:

Payoff to Investor in Non-participating Convertible Preferred Stock

Payoff to Investor in Participating with Cap Convertible Preferred Stock

Payoff to Investor in Fully Participating Preferred Stock

vcAdviser utilizes the financial derivatives valuation methods to estimate the present value of the convertible preferred stock shares. Conceptually, the valuation process is very similar to estimating the value of the stock call options except that the preferred stock derivative specification, reflecting the terms of the VC deal, is much more complex and the performance of the underlying asset, startup enterprise, is harder to predict. Regarding the latter, the estimation of the attributes of the derivative’s underlying asset (such as startup growth rate) are admittedly even more challenging for startups than for publicly traded companies. vcAdvisor sensitivity analysis tool helps address the complexity by enabling the analysis of what-if scenarios that test the impact of variety of assumptions regarding the startup future performance.